Guest Author: S_M (anon)

You should be fully creeped out by the stock market

Stock performance broke the Warren Buffet Indicator recently. Practically, that means the highest ratio of stock value to national GDP ever. The market is overvalued. So number go down… right?

No. The market just keeps running.

On the surface, most people already understand that sustained stock market performance precedes cyclical inflationary deleveraging. But, as the title suggests, is there something downright sinister baked into the structure of the stock market? Yep. Yes, there is dear reader. And its something worth considering and speaking to loved one’s about.

Here’s the lead:

Unless you are very special, you don’t own your stocks

You may want to grab a cup of coffee, splash some cold water on your face… prepare yourself as we dig into the actual code of the United States.

Wait. Does that sound boring? That is exactly the hope. This is what someone doesn’t want you to read.

If it’s written down, you can be sure it is for a reason. If it’s made deliberately complicated, that is a feature not a bug. - Dr. Chris Martenson

The legal structure around our financial system has evolved in two critical ways.

It has been made intentionally complicated so that the average person cannot understand things and will throw up their hands saying, “…this isn’t for me to know or care about…”

The structure has evolved so that vastly preferential treatment is afforded to qualified financial institutions. The “safe harbor” clauses offer what is, effectively, unilateral protection to these entities above anyone else.

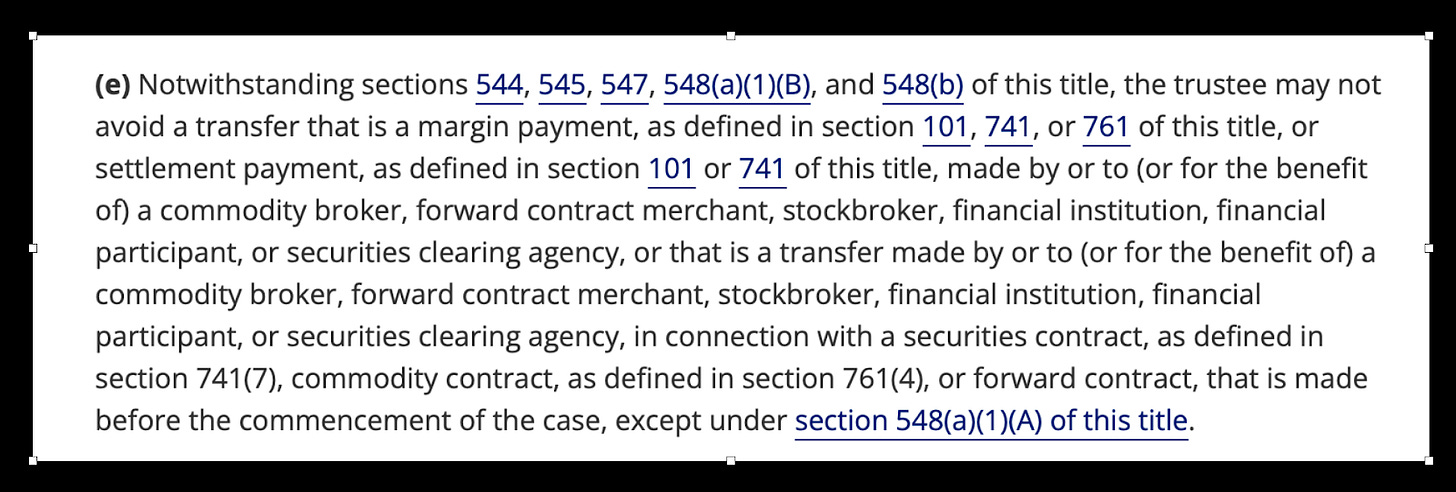

For both of these points, see US Code Title 11 546e as an example.

Charles Mooney Jr explains:

“As reflected by the quoted text, settlement payments generally are protected from avoidance under Bankruptcy Code Section 546(e) if made by, to, or for the benefit of one of the specified types of entities.”

Mooney explains how this safe harbor is the legal foundation for contract security settlements. The next piece to understand is that there are no property rights for securities. You can not find this because it has been slowly dematerialized over time, culminating in 2016. What you own is actually a security entitlement. We are led to believe that we own something but the reality is someone else owns it and has it as collateral. This is also true in Australia, Canada, and Europe.

In legal terms, those who hold stocks, bonds, and other equities are subordinated claimants. Secured creditors are the protected class with safe harbor. They are given universal preference with regard to all payments in debt resolution.

Said differently, if a large entity like Schwab or JP Morgan becomes insolvent, the system is designed to save them. Your security positions are held as collateral and you have no claims to them. These positions can be taken as forfeit collateral and used to right their ship.

This is detailed in Title 8 501d — Besides all of the aforementioned weaknesses of safe harbor clause and the squishy nature of the nature of security entitlements — this bit of code states that the security holder does not have rights entitling them to particular securities in the pool.

The last piece of this puzzle is that the legal precedence for this is already in place. $8.6 billion dollars worth of client money (from Lehman Bros) was taken by JP Morgan and ruled legitimate. The judge’s commentary on the ruling was that there is, essentially, impenetrable protection for these large financial entities with the only exception being total fraud.

Martenson comments, “The only question is do we believe it will happen more? Do we need 42 more examples? When someone shows you who they are and tells you the rules… believe them the first time.”

Why would this ever happen though?

The US is well into the appointed 10-15 year transition for a sunsetting global reserve currency. Hard-backed money has always been most respected, and it will be again. The upstart -and leading candidate for new global reserve currency- is BRICS gold-backed unit (designated mostly for international accounting at this point). In the US, the currency is facing an inevitable hard reset. But before that happens, there will be much, much more inflationary printing. USD has already lost 25% of its purchasing power in the last four years. But the real depth of devaluation hasn’t even started yet.

It takes a loooong time for a tidal wave this big to happen. It took 3 years to reach system failure in the Great Depression (from the moment the first bank failed). Everyone can see it coming and - as a result of bracing for so long - are surprised that it hasn’t made landfall yet. For people who don’t get out of the way, it will be because they stopped taking the warning seriously.

It is now mathematically impossible for the US to pay off its debt (the interest is higher than national “income” each year and more than the cost of defense)

Here are some debt management scenarios for the US…

US will continue to print because it is the least terrible among all of the very bad options

US will also use any possible means of alternative supply inflation including:

Recapitalizing systemically important institutions to manage bad debts

QE

Capital controls

Concepts that are already being floated like paying “unrealized gains”

Cashing in on their footnote clause which allows them to re-name the price of gold/oz overnight. Luke Gromen suggests this could be, functionally, a $5 trillion print.

This is also the moment where American citizens are forced to read all the fine-print they never took the time to read. All of the liberties given away without knowing it — that debt is reckoned. Dalio states a noteworthy characteristic of “depression” phases in cycles:

“Hidden problems like fraudulent accounting and corruption typically come to the surface during such times.”

The repossession of equities (what David Rogers Webb has called “The Great Taking”) There are two scenarios where equities could be taken. It could be the last ditch to pay off debt or part of the “hard reset” on our currency. Equities could be:

nationalized by the government

OR

“liquidated” and claimed as collateral to resolve debts by and/or on behalf of the Cede Company. The legal structure and precedence are already in place for this (detailed in notes at conclusion of this report)

Conclusion

If you just jumped down here for the punchline - its cool but make sure you read the above at some point. You deserve that info. Important info to understand why stocks are (legally) creepy.

But here is that promised TLDR.

Only 17% of Americans actually own their stock (those with special licenses). The other 83% follows a breadcrumb trail of claims that all lead to Cede Company.

US debt is 34.8 trillion. US Citizens have $38 trillion in 401k-type investments.

To be clear, the author is not saying what is GOING to happen. But it’s very creepy that this CAN happen. Legally.

In 2001 the US introduced “catch-up contributions” for retirement.

Translation: “You are behind. But good news. We are nice. You can put more money in the stock market.”

Understand the times.

Self-custody of your assets is the way.

Now more than ever.